“This has been a source-intense credit history for IRS groups to evaluate,” Werfel explained. “Sadly, the problem was compounded by misleading promoting flooding businesses to claim these credits, making a best storm that included threat of inappropriate payments for taxpayers and The federal government although complicating processing for that IRS and slowing promises to genuine corporations.”

The IRS launched Earnings Method 2021-33 in Aug. 2021 that gives a safe harbor underneath which an employer could exclude the quantity of the forgiveness of the PPP mortgage and the level of a Shuttered Venue Operators Grant or maybe a Restaurant Revitalization Fund grant through the definition of gross receipts entirely for the purpose of pinpointing eligibility to claim the ERTC. Companies will have to use the Harmless harbor constantly throughout all entities.

Courtroom-All set legal professionals who can take care of disputes early on clientele’ phrases or prevail at demo prior to a choose or jury.

In fact, corporations can perform a lookback to ascertain whenever they meet up with the eligibility necessities. Within the existing time, corporations have until finally April 15, 2025, to file amended returns for your quarters in 2021 by which they had been eligible to claim the ERC.

Deliver your Speak to information and facts: This is often optional but will likely be useful if We've got queries and will allow us to accept receipt of your respective referral

Businesses really should be wary of ERC commercials that recommend them to "use" for revenue by proclaiming the ERC every time they might not qualify.

For those who received a refund Verify but haven’t cashed or deposited it, it is possible to however withdraw your assert. You'll want to mail the voided Look at with all your withdrawal ask for working with these steps:

Promoters who will be internet marketing this in the long run Have a very vested desire in generating cash; in several instances they're not searching out for the most beneficial passions of Those people applying.

When questioned for evidence on how The federal government buy suspended a get more info lot more than a nominal part of their organization operations, numerous companies haven’t supplied enough information to substantiate eligibility.

Businesses nonetheless have time to claim the ERC, Even though that may modify Together with the proposed legislation. Paychex will help them recognize what’s necessary to Test on their own eligibility.

Before you file for your ERTC, you must know which forms you have to use. So that you can properly file in your credit rating, you need to use type 941-X.

Your company need to also not have yearly gross receipts that don’t exceed one million dollars. Recovery startup businesses aren't eligible for ERTC funds underneath the two mentioned above types.

Leveraging major-edge technology to information change and generate seamless, collaborative ordeals for clientele and Lawyers.

No matter whether the staff presented providers with the wages you paid over the suspension of operations or perhaps the quarter during which you experienced the essential decline in gross receipts;

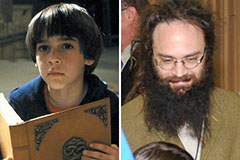

Edward Furlong Then & Now!

Edward Furlong Then & Now! Jaleel White Then & Now!

Jaleel White Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now!